Some analyst are claiming the good economic indicators we are seeing today are really portents of a recession.

James Lyman BSAE, BSEE, MSSM

Fears of another recession are particularly acute for the millennials and Z-generation, because in general, they are the first to suffer the most from an economic downturn. This was seen in the 2008 downturn and is a consequence of our service economy, where for so many Americans, their economic value is as consumers, rather than substantive contributors to society. As consumers, they are particularly vulnerable to any economic downturn . . . to a recession. So what is causing some economic experts to think we may soon have a recession?

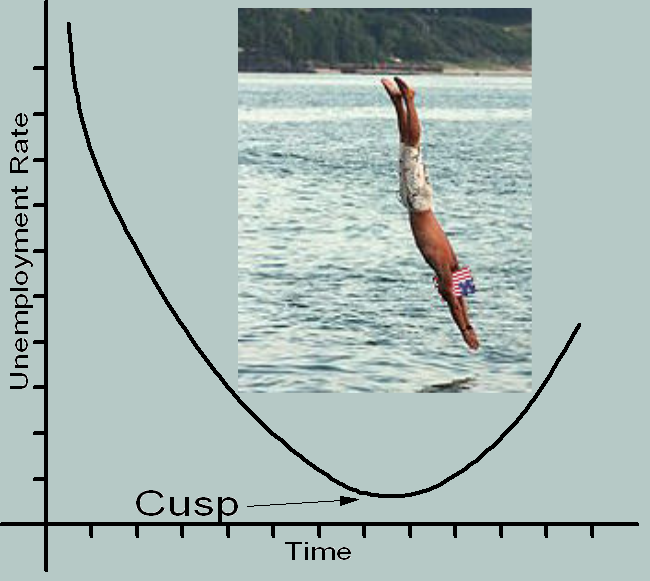

Some point to the fact that for the last 10 recessions in America, a recession quickly followed when the economy hits full employment. In other words, when the unemployment rate reaches a minimum cusp . . . in as little as a few months the economy starts a down slide. The average time between when the cusp occurs and when the recessions starts is just 3.8 months, and for 3 downturns it was just 1 month after, with the longest being 10 months. This trend started in 1950, a time when automation was starting to make inroads in American society, and a decade or so before the decline of manufacturing in America started. Therefore, we must view this hypophysis with the realization that the environment was changing, and that this may have had a profound effect.

But the problem with using this correlation as a predictor is it’s all hindsight. To know if a recession is nearing, you must know when you’ve actually reached the cusp. This April, the unemployment was down to 3.9 percent, a 17-year low, but since then it’s dropped to 3.7% and may well continue down. There’s no way of knowing when the cusp has been reached until the unemployment rate starts back up. But with the rate already one of the lowest, there’s less and less chance it will go much lower.

A low employment rate indicates that the labor force is fully utilized, but why would that indicate the onset of a recession? What’s the forcing function? What’s the relationship? Without knowing that, using this empirical relationship could be erroneous. For one thing, the hypotheses assumes a constant environment, specifically when it doesn’t consider the growing obsolescence of people, and their displacement by technology. This is an important consideration for our hyper-consumerism economy, because displacement of workers means fewer consumers and therefore a shrinking economy. A shrinking economy, for whatever reason, is the basic ingredient for a recession. So it’s safe to say, that the good economic indicators we are presently seeing, will most likely not continue for long, regardless of which political entity is in power.

Even though the past performance of a system is no guarantee of how that system will react in the future, you can’t just ‘out-of-hand’ dismiss the correlation of low unemployment cusp and the onset of a recession. This next unemployment low may not foretell the onset of a recession, but then again, it may just as well happen as seen with the last ten recessions. We can’t know with any certainty until after the fact. While President Trump has created a stimulating environment for American business and the economy, there are a number of factors in which neither he, or anyone else has control over, that can bring an end to that stimulation. The instability of world economies in Europe and Asia to start with. China’s blend of communism and capitalistic economics is showing to be more and more unstable. If China’s down slide continues, what effects will that have on our economy? Again, there’s no way of knowing until after the fact.

The millennials and Z-generation are the first to feel and suffer in a recession, mainly because so many of them now have ‘shallow’ jobs requiring little to no skills. People who’s work hours can easily be reduced when business slows, or simply laid off. In turn, with reduced income their effect as consumers is reduced, and that in turn further exacerbates an economic downturn.

Possibly the cusp in unemployment isn’t a forcing function, rather it is an artifact of other forces causing a downturn, that in turn results in unemployment starting to rise again to form that cusp. This would make the validity of the hypophysis more palatable and hence acceptable. There are other indicators that economic problems may be just over the horizon, such as the contraction of the big box stores, the foundation of hyper-consumerism. Also there are problems with house sales declining, rising mortgage rates and a decline in house prices. The rising US debt is adding further pressure on the economy to support what many consider unsustainable. And finally, the frailty of so many world economies presents a major threat to the US economic viability. A sever downturn of the fragile economies such as Greece, Spain or Italy could start a chain reaction that also pulls America’s economy down.

But even if the millennials and Z-generation know of a coming recession, what can they do to protect themselves? Well, first of all, minimize personal debt as much as possible, and that starts right now. Just because things are booming now, that doesn’t mean you have to go out and buy things on credit. Shop the same as when times aren’t so rosy. If at all possible, save up and pay cash. The personal debt factor, more than anything else, is what causes people their biggest problems in a recession, especially if looking for new work.

Be more flexible by increasing skills and education now, particularly technical skills such as mathematics and science. This is the twenty-first century, not the eighteenth or nineteenth century, and eighteenth century people have far fewer opportunities in this century. Try and avoid careers directly involved in hyper consumerism, since consumerism is usually the first to feel the effects of a recession. In other words, try and stay off the thin ice.

More than anything else, thinking ahead can do more

than anything else, in weathering a recession.